Commercial Package

MSI’s package policy offers community associations broad and high-limit property and liability coverage along with crime protection and a range of additional programs

Commercial Package

MSI’s package policy offers community associations broad and high-limit property and liability coverage along with crime protection and a range of additional programs

Commercial Package

MSI’s package policy offers community associations broad and high-limit property and liability coverage along with crime protection and a range of additional programs

Packed with coverage, MSI’s commercial package delivers for community associations

Commercial package policies offer essential property and liability protection for most organizations. However, community associations often have unique needs that extend beyond the typical coverages and limits of these policies. MSI’s Preferred Property Program team has worked closely with these associations for more than 25 years, now insuring more than 30,000 of them for various coverages, so we have a deep understanding of their exposures.

We provide a specialized commercial package policy for associations that offers primary property coverage up to $12 million per building for frame and joisted masonry construction and no cap for modified fire resistive and fire resistive construction. For liability, the package provides up to $2 million of primary coverage, with up to $75 million of umbrella coverage available. This package is available in many states through highly-rated insurers.

Our comprehensive property coverage features guaranteed replacement cost on buildings, coverage for foundations, equipment breakdown, community property and much more. On the liability side, our enhancements include no general aggregate, coverage for host liquor liability and contractual liability, and extended fire and water legal liability.

Crime coverage rounds out comprehensive package

Our package also has built-in worldwide crime coverage for employee dishonesty, depositors’ forgery and computer fraud, and we can easily add on a range of optional programs, including directors and officers liability, employment practices liability, cyber, workers compensation and environmental coverages.

In addition, in a limited number of states we offer a commercial package for apartment complexes, residential and commercial associations, and lessors risk only properties, such as shopping centers and office complexes, with the same primary property and liability limits as the associations package above, but with a $150 million total property coverage cap.

MSI provides responsive service during every phase of the policy, beginning with our online submission process. Our underwriting experts deliver custom quotes and bind coverage rapidly while our dedicated claims team has the extensive experience with a wide range of commercial losses needed to resolve claims promptly and fairly.

Count on MSI for commercial package and several other coverages designed to provide a blanket of protection around community associations.

Packed with coverage, MSI’s commercial package delivers for community associations

Commercial package policies offer essential property and liability protection for most organizations. However, community associations often have unique needs that extend beyond the typical coverages and limits of these policies. MSI’s Preferred Property Program team has worked closely with these associations for more than 25 years, now insuring more than 30,000 of them for various coverages, so we have a deep understanding of their exposures.

We provide a specialized commercial package policy for associations that offers primary property coverage up to $12 million per building for frame and joisted masonry construction and no cap for modified fire resistive and fire resistive construction. For liability, the package provides up to $2 million of primary coverage, with up to $75 million of umbrella coverage available. This package is available in many states through highly-rated insurers.

Our comprehensive property coverage features guaranteed replacement cost on buildings, coverage for foundations, equipment breakdown, community property and much more. On the liability side, our enhancements include no general aggregate, coverage for host liquor liability and contractual liability, and extended fire and water legal liability.

Crime coverage rounds out comprehensive package

Our package also has built-in worldwide crime coverage for employee dishonesty, depositors’ forgery and computer fraud, and we can easily add on a range of optional programs, including directors and officers liability, employment practices liability, cyber, workers compensation and environmental coverages.

In addition, in a limited number of states we offer a commercial package for apartment complexes, residential and commercial associations, and lessors risk only properties, such as shopping centers and office complexes, with the same primary property and liability limits as the associations package above, but with a $150 million total property coverage cap.

MSI provides responsive service during every phase of the policy, beginning with our online submission process. Our underwriting experts deliver custom quotes and bind coverage rapidly while our dedicated claims team has the extensive experience with a wide range of commercial losses needed to resolve claims promptly and fairly.

Count on MSI for commercial package and several other coverages designed to provide a blanket of protection around community associations.

Packed with coverage, MSI’s commercial package delivers for community associations

Commercial package policies offer essential property and liability protection for most organizations. However, community associations often have unique needs. MSI’s Preferred Property Program team has worked closely with these associations for more than 25 years, so we have a deep understanding of their exposures.

We provide a specialized commercial package policy for associations that offers primary property coverage up to $12 million per building for frame and joisted masonry construction and no cap for modified fire resistive and fire resistive construction. For liability, the package provides up to $2 million of primary coverage, with up to $75 million of umbrella coverage available. This package is available in many states through highly-rated insurers.

Crime coverage rounds out comprehensive package

Our package also has built-in worldwide crime coverage for employee dishonesty, depositors’ forgery and computer fraud, and we can easily add on a range of optional programs.

In addition, in several states, we offer a similar package for apartment complexes, residential and commercial associations, and lessors risk-only properties, such as shopping centers and office complexes.

MSI provides responsive service during every phase of the policy, from underwriting experts delivering custom quotes and binding coverage rapidly to our dedicated claims team resolving claims promptly.

Availability

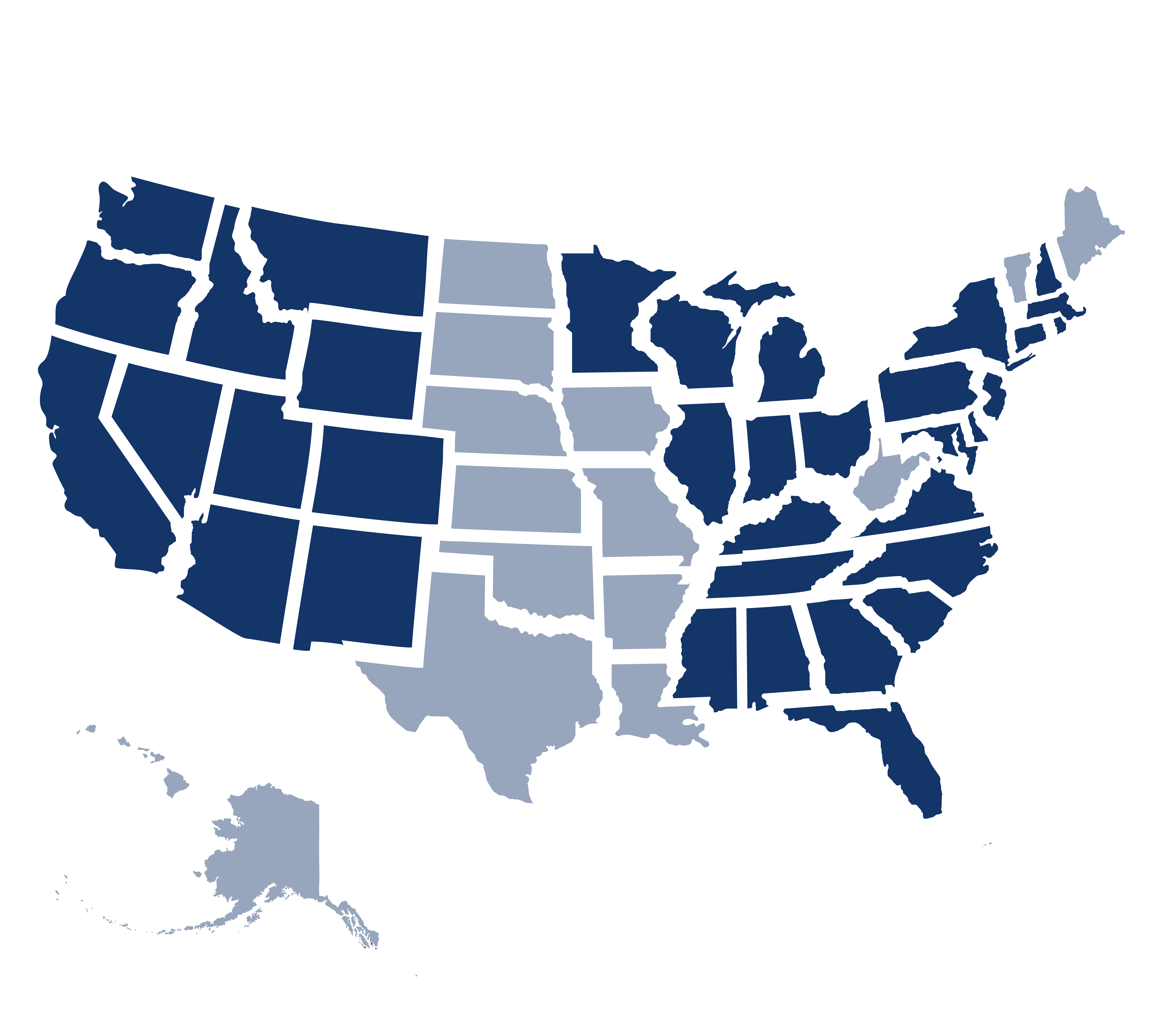

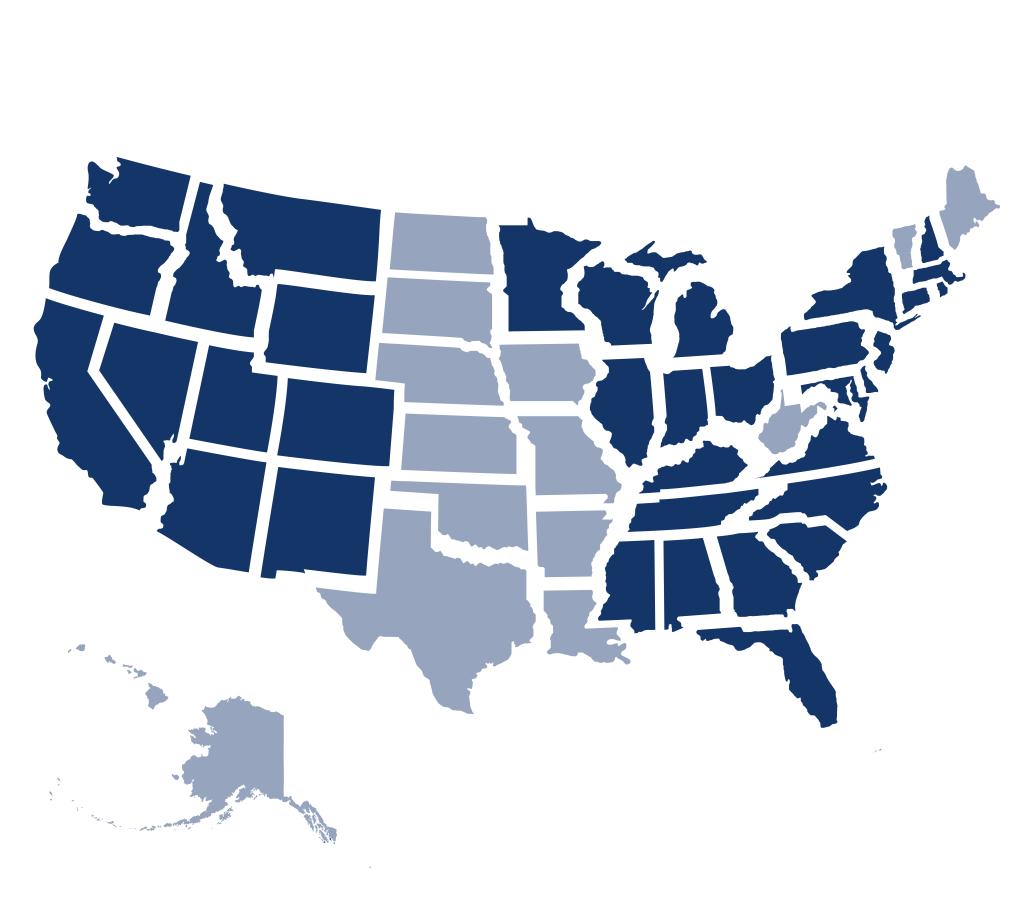

Community Associations Package

• Arizona, California, Colorado, Connecticut, Delaware, Georgia, Idaho, Illinois, Indiana Kentucky, Maryland, Massachusetts, Michigan, Minnesota, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York (excluding the boroughs except Staten Island), Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina (excluding Beaufort, Berkeley, Charleston, Colleton, Georgetown, Horry, Jasper, Dillon, Dorchester, Florence, Hampton, Marion, Williamsburg), Tennessee, Utah, Virginia, Washington, Wisconsin, Wyoming, and Washington D.C.

Apartment Complexes, Residential and Commercial Associations, and Lessors Risk Only Package

• Connecticut, Delaware, Illinois, Indiana, Massachusetts, Maryland, Michigan, Minnesota, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Virginia, and Washington D.C.

Coverage

Property

- Primary coverage up to $12 million per building for frame and joisted masonry construction and no per building cap for modified fire resistive and fire-resistive construction, with no overall coverage cap ($150 million total cap for apartment complexes and lessors risk only package)

- Guaranteed Replacement Cost on building

- Sewer Backup

- Off Premises Power Failure

- Explosion of steam boilers, steam pipes, steam engines or steam turbines (Equipment Breakdown)

- Ordinance and Law

- Computer Virus coverage included at an annual limit of $5,000

Liability

- Up to $2 million of primary coverage

- $50 million umbrella limits available through Preferred Property Program and up to $75 million umbrella limits available through AURA

- No General Aggregate

- Host Liquor Liability

- Contractual Liability

- Fire and Water Legal liability extended to include all special causes of loss

Worldwide Crime

- Basic Limit: $150,000 (Employee Dishonesty, Depositors Forgery and Computer Fraud)

- Full ALS coverage is available

Eligibility Classes

- Community Associations

- Residential and Office Condominiums

- Cooperative Apartments

- Homeowners Associations

- Planned Unit Developments

- Property Owners Associations

Partners integrating MSI’s tech platform

Why MSI?

Why MSI?

Contact Us

"*" indicates required fields